Anúncios

Traveling is one of life’s greatest joys, offering new experiences and unforgettable memories. However, unexpected events can disrupt even the most carefully planned trips.

This is where travel insurance comes into play, providing peace of mind and financial protection. But how much does this essential safety net really cost in the US? Understanding travel insurance costs can feel like unraveling a mystery. You might wonder if it’s an unnecessary expense or a crucial part of your travel budget.

Anúncios

This article will uncover what factors influence travel insurance prices and how you can ensure you’re getting the best value for your money. By the end, you’ll be equipped with the knowledge to make an informed decision, so you can travel with confidence and security. Dive in, and discover how you can protect your journey without breaking the bank.

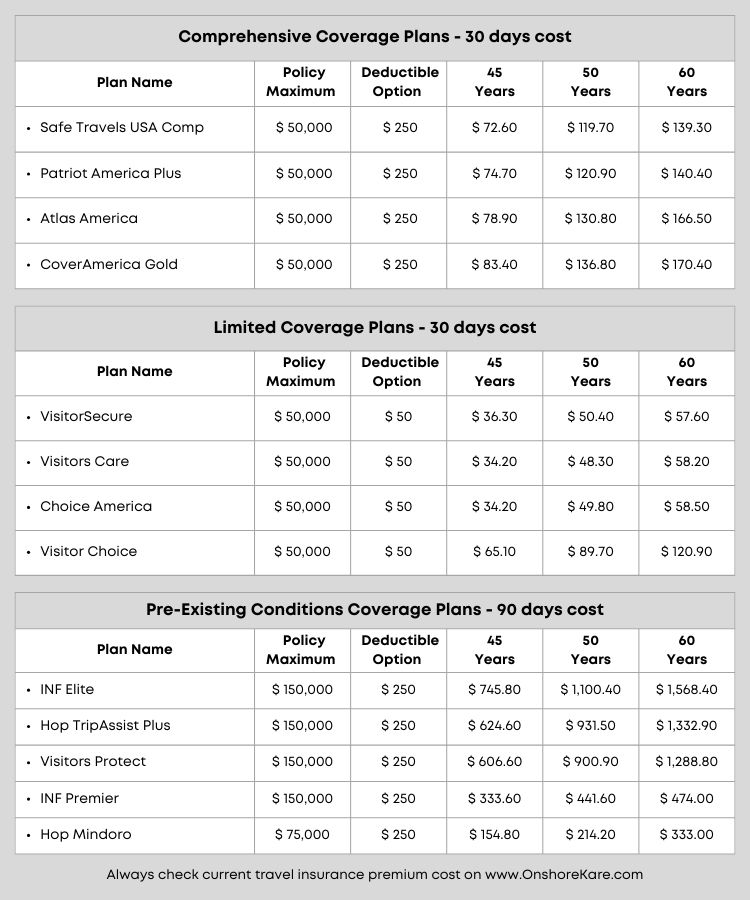

Credit: onshorekare.com

Anúncios

Factors Influencing Travel Insurance Cost

Travel insurance costs in the US depend on trip length, coverage level, and traveler age. Medical conditions can raise prices. Destination risks also affect premiums.

Travel insurance prices vary widely in the US. Different factors influence these costs. Knowing them can help in choosing the right plan.

Type Of Coverage

The coverage type affects insurance cost. Basic plans are cheaper. Comprehensive plans are more expensive. They offer more protection. Medical coverage costs more than trip cancellation. Emergency evacuation is also costly. Choose coverage based on needs.

Trip Duration

Longer trips cost more to insure. Insurance companies charge based on trip length. Short trips have lower premiums. Extended vacations increase risk. This results in higher costs. Assess trip length before buying insurance.

Traveler’s Age

Age plays a key role in pricing. Older travelers face higher premiums. They are seen as high-risk. Young travelers pay less. Insurance for seniors is costly. Age affects medical coverage too. Consider age when comparing insurance plans.

Destination

The destination impacts insurance rates. Some places are riskier. Travel insurance for high-risk areas costs more. Safe destinations are cheaper to insure. Political stability affects pricing. Health risks in the destination also matter. Research destination risks before buying insurance.

Trip Cost

Expensive trips need more insurance. Higher trip costs lead to higher premiums. Insurers cover the trip’s total cost. Trip cancellation insurance depends on trip value. Costly vacations require more protection. Evaluate trip expenses for suitable insurance coverage.

Average Cost Of Travel Insurance

Travel insurance in the US typically costs 4% to 10% of your trip’s total price. Factors like age, destination, and coverage level influence the price. Choosing the right plan ensures peace of mind during your journey.

Travel insurance is like a safety net for your adventures, but how much should you really budget for it? Understanding the average cost can help you make informed decisions and potentially save money. The cost varies based on several factors, including the destination, trip duration, and coverage type. Let’s dive into some specifics.

Domestic Vs. International Travel

Travel insurance for domestic trips is generally less expensive than for international journeys. This is because international travel often involves higher medical and evacuation costs. A domestic travel insurance policy might cost you around $30 to $50 per trip, whereas an international one could range from $100 to $200. But does the added cost for international insurance offer more peace of mind? Imagine your international adventure suddenly interrupted by an unforeseen event. The comprehensive coverage could be worth every penny, offering you assistance in unfamiliar territories.

Single Trip Vs. Annual Plans

Single trip plans are ideal if you travel occasionally. They cover you for one specific trip, making it easier to manage costs. Prices can vary from 4% to 10% of your total trip cost. On the other hand, if you’re a frequent traveler, annual plans might be more economical. They provide coverage for multiple trips throughout the year. An annual plan could set you back about $500, which is a bargain if you plan on taking several trips. Do you travel multiple times a year? An annual plan not only saves money but also saves the hassle of purchasing insurance for every trip. It’s one less thing to worry about, letting you focus on the excitement of your next adventure. Understanding these nuances can help you choose the most cost-effective travel insurance. What kind of traveler are you? Use that insight to select a plan that best fits your journey.

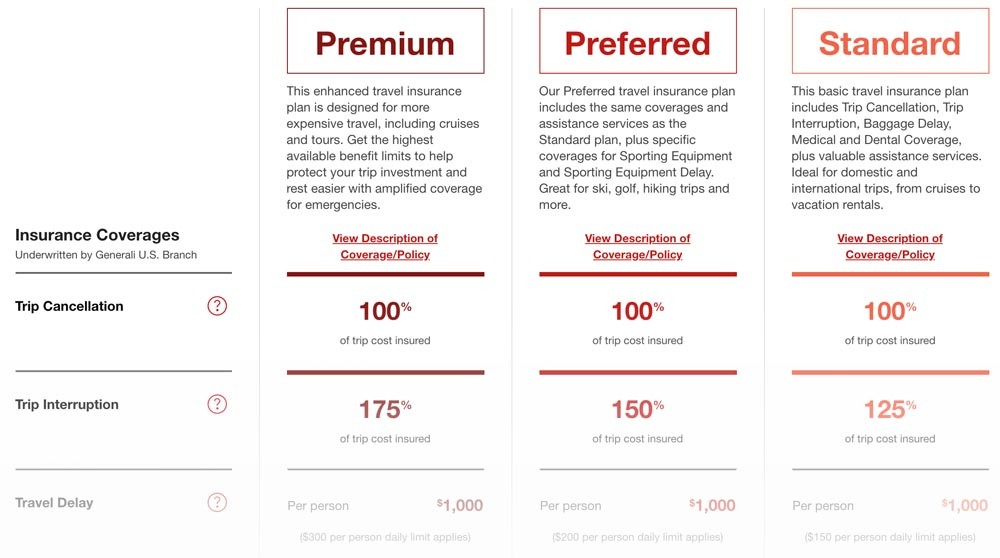

Types Of Travel Insurance Plans

Travel insurance in the US offers a variety of plans to suit different needs. Understanding these options helps you choose the right coverage for your trip. Let’s explore the types of travel insurance plans available.

Basic Coverage

Basic coverage plans offer essential protection for travelers. They usually cover trip cancellations and delays. Medical emergencies during your trip are also included. This plan is perfect for short trips and domestic travel. It provides peace of mind without breaking the bank.

Comprehensive Coverage

Comprehensive coverage provides broader protection than basic plans. It includes everything from basic coverage plus more. Lost luggage and personal belongings are covered. Emergency evacuations and extended medical coverage are also part of this plan. Ideal for international trips or long vacations. Comprehensive plans ensure you are prepared for anything.

Specialty Plans

Specialty plans cater to specific needs or activities. These include coverage for adventure sports or business travel. If you have unique travel requirements, specialty plans are available. They offer protection tailored to your specific activities or needs. Perfect for those who travel for work or adventure.

How To Compare Travel Insurance Quotes

Travel insurance can be a lifesaver during unexpected events. But how much should you really pay? To find the best deal, it’s essential to compare quotes. This ensures you get the right coverage without overpaying. Let’s explore some effective ways to compare travel insurance quotes.

Online Comparison Tools

Online comparison tools simplify the process of finding travel insurance. They gather information from various providers in one place. You can easily view different options side by side. This helps in understanding what each policy covers. Many tools allow you to filter results based on your needs. Choose a tool that offers a wide range of options. This ensures you don’t miss out on the best deals.

Key Policy Features

Always check the key features of each travel insurance policy. Coverage for medical emergencies is crucial. Look for policies that cover trip cancellations or interruptions. Lost luggage coverage can save you a lot of hassle. Check if the policy includes 24-hour emergency assistance. This feature provides peace of mind during your travels. Reading the fine print is vital. It helps you understand any exclusions or limitations.

Tips For Saving On Travel Insurance

Travel insurance can protect you during your trips. Yet, costs can add up quickly. Many travelers search for ways to save. Here are some practical tips. Each can help cut down on expenses. They ensure you get the best deal possible.

Early Purchase Discounts

Buy travel insurance soon after booking your trip. Many companies offer early purchase discounts. These incentives reward early planners. You get peace of mind and save money. The earlier you buy, the more you may save.

Group Discounts

Traveling with family or friends? Consider a group travel insurance plan. Insurers often offer discounts for groups. This can reduce individual costs significantly. It’s a smart way to protect everyone without overspending. Always ask about group options.

Bundling With Other Insurance

Check if you can bundle travel insurance with other policies. Insurers often provide discounts for bundling services. This might include health or home insurance. Bundling can simplify management and reduce costs. It’s an effective way to lower your travel expenses.

Credit: www.generalitravelinsurance.com

Common Myths About Travel Insurance Costs

Travel insurance is often misunderstood, especially when it comes to its cost. Many travelers shy away from purchasing it due to misconceptions about its price. Let’s debunk some common myths about travel insurance costs to help you make informed decisions.

Assumptions About Coverage

One common myth is that travel insurance covers everything at a high cost. You might think that a comprehensive policy will break the bank, but that’s not always true. Policies can be tailored to fit your specific needs and budget, offering coverage for only what you actually require. For example, if you’re not planning any adventurous activities, you can choose a policy that excludes such coverage, reducing your premium.

Consider your trip’s specifics to find a policy that works for you. You may not need a premium package if you’re traveling domestically for a short period. Understanding what you need can help you avoid overpaying for unnecessary coverage.

Price Vs. Value Misconceptions

Another myth is equating the cost of travel insurance directly with its value. It’s easy to assume that a lower-priced policy offers less value, but this isn’t always the case. A cost-effective policy can provide excellent coverage if it aligns with your travel plans and needs.

Think of travel insurance like a safety net. It might seem like an extra cost, but its real value becomes apparent when you face unexpected situations. Whether it’s a sudden illness, lost luggage, or a canceled flight, the peace of mind it provides is invaluable.

Have you ever faced a travel hiccup and wished you had a backup plan? That’s where understanding the value of a well-chosen travel insurance policy comes into play. The right policy can save you significant time, stress, and money when things don’t go as planned.

As you plan your next trip, challenge these common myths about travel insurance costs. Look beyond price tags and consider the peace of mind and protection you gain. Isn’t that worth a closer look?

Credit: www.nimblefins.co.uk

Frequently Asked Questions

What Factors Affect Travel Insurance Cost In The Us?

Travel insurance costs vary based on trip duration, destination, age, and coverage level. Longer trips and higher-risk locations may increase premiums. Age and health conditions can also affect pricing, as older travelers may face higher rates. Choosing comprehensive coverage will typically cost more than basic plans.

Is Travel Insurance Worth The Cost?

Travel insurance provides peace of mind and financial protection. It covers unexpected events like medical emergencies, trip cancellations, and lost luggage. For a relatively small cost, it can save substantial expenses and stress. Assess your travel plans and potential risks to decide if it’s a worthwhile investment.

How To Find Affordable Travel Insurance?

Compare multiple providers and plans for the best rates. Online comparison tools can help identify cost-effective options. Consider bundling travel insurance with other policies for discounts. Adjust coverage limits to suit your needs, and avoid unnecessary add-ons to keep costs manageable.

Can I Get Travel Insurance For Pre-existing Conditions?

Yes, some insurers offer coverage for pre-existing conditions. You’ll need to disclose your condition during application. Coverage may come with limitations or higher premiums, but options are available. It’s crucial to understand the specific terms and conditions before purchasing the plan.

Conclusion

Travel insurance costs vary widely in the US. Factors include age, trip length, and coverage details. Comparing plans is crucial. This ensures you find the best fit. Prices can range from a few dollars to hundreds. It’s important to assess your needs carefully.

Budget wisely for peace of mind. Remember, the cheapest option might not be ideal. Choose a plan that offers both protection and value. With smart choices, travel becomes safer and worry-free. Enjoy your journey knowing you’re covered.